The specific cutoff date in November is typically announced in October in the QuickAlerts Library. Once the IRS is open for e-filing you can e-file again.

Irs Tax Return Forms And Schedule For Tax Year 2022

November 16 2019 - January 27 2020.

. E-filing is supposed to open sometime today on January 3. Tax year 2019 and 2020 returns can still be e-filed when the IRS re-opens for the tax year 2021 filing season. Dont wait to file.

IndividualFiduciary due dates for calendar year filers. You can file Form 1040-X Amended US. Modernized e-File MeF System Resiliency.

Ready set file. 4203 Hourstil Oct. Business 1041 1065 1120 990 2290 Shut down from.

Ad Quickly File Your 2019 Taxes With Simple Step-by-Step Guidance. Easy Fast Secure. Treasury department have extended the federal filing and tax payment deadlines to July 15 2020.

If you transmit a 1040 Individual e-file to us well send a rejection. Ad Prevent Tax Liens From Being Imposed On You. Individual Shutdown began on Saturday November 20 2021 at 1159 pm.

If you have a balance due and. What is your hurry though. The filing deadline for tax year 2019.

The IRS started processing tax returns on Monday January 24 2022. You can find more. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR.

Whether you want to do. Starting with Release 105 start date 10122021 for ATS and January 2022 for Production MeF has implemented a new feature. Ad Quickly File Your 2019 Taxes With Simple Step-by-Step Guidance.

December 26 2019 - January 7 2020. When can I file for 2019. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try.

The other tax deadlines for estimated payments are April 15th June 15th and September 15th. The Internal Revenue Service extended the 2019 federal income tax filing and payment deadline for three months from April 15 to July 15 2020. The extension was given in.

Yes electronically filed tax returns are accepted until November. Maximize Your Tax Refund. The shutdown dates are.

CPA Professional Review. January 3 2022 is the first day to transmit. If October 15 falls on a weekend or legal holiday you have until midnight the next business day following October 15 to timely file your tax return.

If you miss the April 18 2022 deadline to prepare and e-File a 2021 Tax Return or you e-Filed an extension by that date you can e-File your 2021 Taxes. The IRS and the US. Fiduciary due dates for fiscal year filers.

Even when you e-file your 2019 tax return be aware that. File today with TurboTax and be first in line for your tax refund. 7 and will begin accepting individual returns on Jan.

It shuts down once a year for maintenance. The IRS has announced that it will begin accepting 2019 e-filed business returns on Jan. Note - If you file your tax return and pay all taxes due by February 2nd the fourth payment is.

Last Date For Issuing Form 16 Extended Till July 31 Here S How You May Still File Itr For Ay 2021 22 The Financial Express

Process Of Filing Itr 1 Under New Income Tax E Filing Portal 2 0

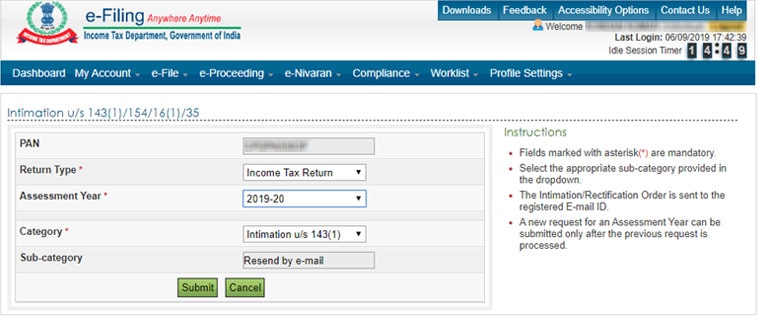

Notice U S 143 1 Income Tax Intimation U S 143 1 Tax2win

How To Download And Import Prefilled Xml To Itr Utility

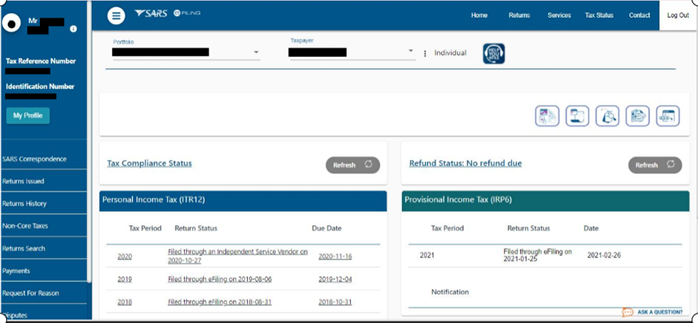

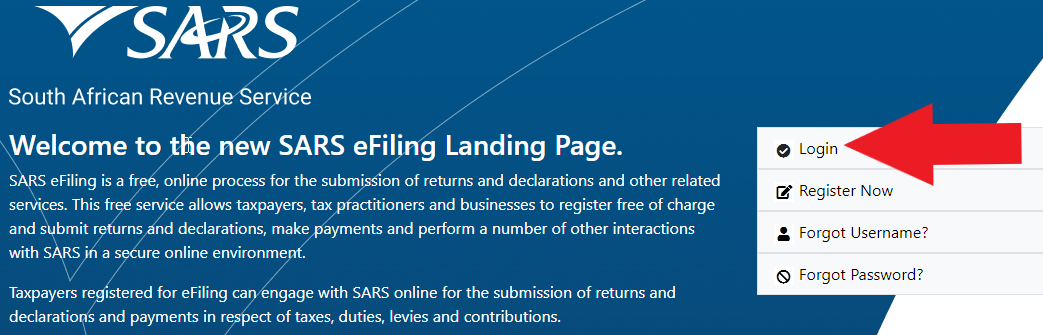

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

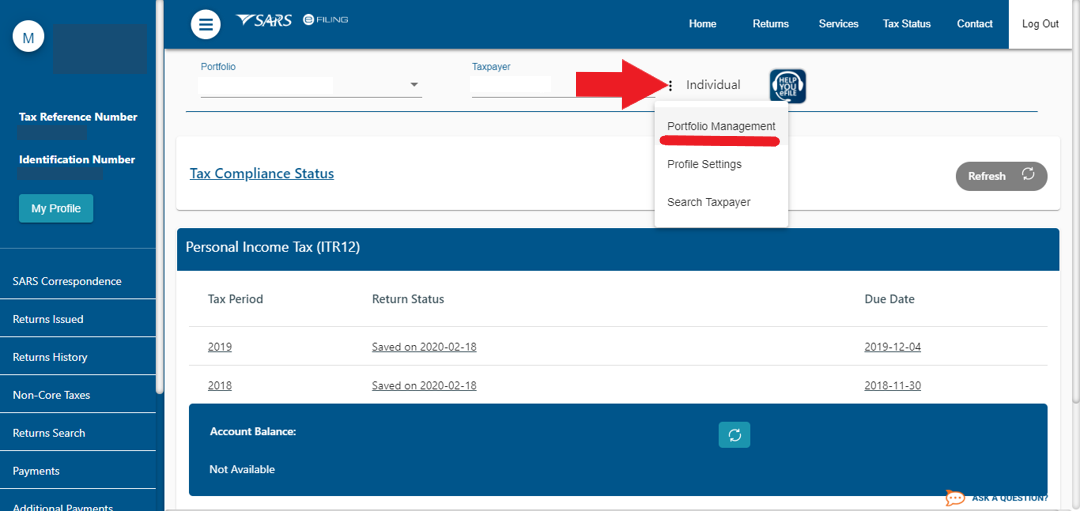

How To Register Your Company For Sars Efiling Taxtim Sa

Process Of Filing Itr 1 Under New Income Tax E Filing Portal 2 0

Process Of Filing Itr 1 Under New Income Tax E Filing Portal 2 0

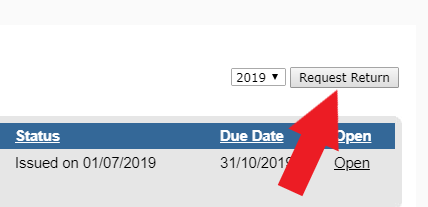

Reprocess The Itr E Filing Portal Learn By Quickolearn By Quicko

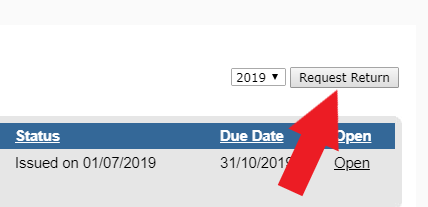

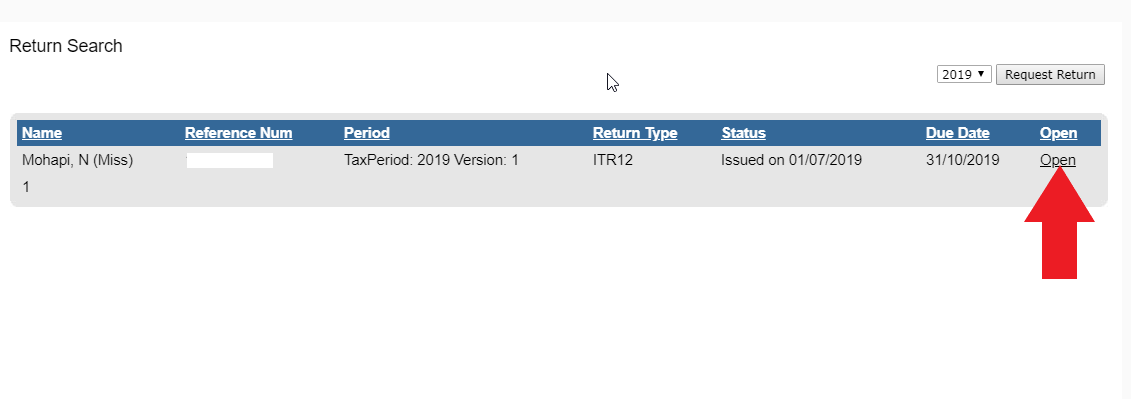

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

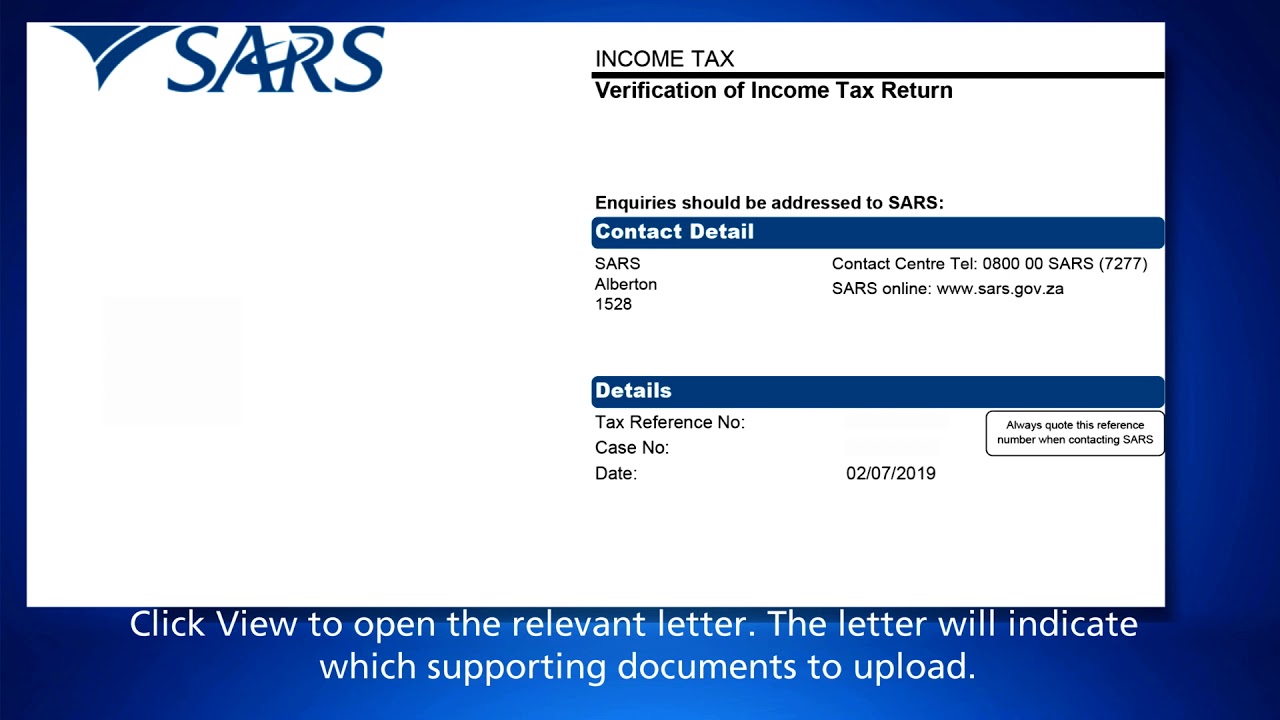

Sars Efiling How To Submit Documents Youtube

Sars Efiling How To Submit Your Itr12 Youtube

Ctos Lhdn E Filing Guide For Clueless Employees

Process Of Filing Itr 1 Under New Income Tax E Filing Portal 2 0

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa